Strategic management Case Study

Follow this link to access the pdf format https://mitsloan.mit.edu/LearningEdge/CaseDocs/09-092%20CX%20Technology%20Lehrich.pdf

CX Technology

Ketan Bhole, Jordan Lee, Eileen Lu, Indrajit Sen

As Albert Ting, Chairman of CX Technology, walked across the factory grounds in January 2009 on his way back from lunch, he paused and listened. The mid-afternoon sun in Ho Chi Minh City, Vietnam, seared the pathway, but there, across from him, stood the different warehouses bustling with activity in their cool obscurity. The regular clanking of pressed steel followed by the predictable sighs of yielding pistons suggested that business was going on as usual. In 2007, CX Technology had booked over US$51 million in revenue and was one of the leading global manufacturers of cold forged steel speaker components. Some of the world’s best-known speaker brands used the company’s products, including JBL, Harman Kardon, Onkyo, and Pioneer, and many had been loyal customers for over 20 years.

Ting however sensed that changes needed to be made. While revenue was reasonably stable, the rate at which new business was coming in was not reassuring. Cold forged steel speaker components were a commodity product, whose supply chain was susceptible to consolidation. Furthermore, industry cost containment measures were relentless in squeezing the margins of suppliers such as CX Technology. To secure the company’s future, Ting knew he needed to diversify and develop the business. Along with his management team, he had thought at length about expanding into the automotive industry. But the pending global economic crisis of 2009 had already claimed its first victims, including the once-mighty Detroit car companies who were now asking for government bailouts. Embarking CX Technology on a road not yet traveled would be precarious. As he walked on, Ting asked himself whether he should indeed expand into automotive, and if so, where and how.

Steel Forging

Steel had been produced for thousands of years, dating as far back as 1400 BC. Raw steel was composed of iron, with levels of carbon content varying from 0.2% to 2.14% by weight. Steel could be manufactured by several metalworking processes, such as casting, but the strongest steel parts were usually produced by forging. Forging processes were most appropriate for applications where reliability and safety were critical and where production volumes were high enough to offset high tooling costs. The size, complexity, strength, and precision of the end product often dictated what type of forging process was used.

Hot forging occurred at high temperatures, up to 2,300˚F.2 This process was most commonly used for large objects, such as structural beams and aircraft frames, that required significant deformation to produce the final shape. This could sometimes only be achieved by melting the steel significantly to increase ductility and malleability.

Warm forging, as the name implied, ran cooler than hot forging. Temperatures ranged from 800˚F to 1,800˚F, although the narrower range of 1,000˚F to 1,330˚F was more commonly used in commercial applications. Warm forging had several potential advantages over cold forging: reduced tooling and press loads, increased steel ductility, and the elimination of the annealing process prior to forging. However, these advantages came at the expense of more material waste, a slightly more complex process requiring additional equipment, and a finished product of weaker strength.

Cold forging, the only process in which CX Technology had capabilities, involved forging steel at or near room temperatures. The parts produced were typically symmetrical and rarely exceeded 25 lbs. The primary advantage of cold forging was the material savings achieved as well as the resultant high-precision shapes that required little finishing. Cold forging also improved physical properties of the finished product.

Cold Forging Process and Applications

Cold forged parts were typically components – washers, screws, clips, etc. There were countless applications in which they could potentially be used, from airplanes, automobiles, oil drilling equipment, engines, and missiles to smaller commercial products such as bicycles, air conditioners, and even handguns. Cold forging was also especially useful in producing low to moderately complex parts (e.g., axis-symmetrical parts) which had to adhere to tight geometric tolerances and high stress loads. Since cold forging did not involve intense heat treatment, the steel maintained its natural composition, resulting in high strength. These properties made cold forging suitable for parts such as flanges, yokes, and simple gears: low-complexity parts that underwent tremendous stress within the workings of a larger machine.

Capabilities in manufacturing and quality assurance depended on the parts being produced. For example, automotive and military applications required extremely tight tolerances due to safety and thermal considerations, while air conditioners had less stringent requirements. Manufacturing scalability and flexibility requirements were also important, since any given part could take on any number of shapes and sizes, with product specifications varying by application. In fact, it was common for a single customer to order multiple variants of the same part to use in its different products (e.g., a speaker manufacturer would have several speaker products, each requiring a different yoke component). This meant that cold forging manufacturers had to have enough capacity and quick enough reactions to win new projects from new and existing customers. Even long-standing cold forging experts had to have the flexibility to meet – or anticipate – shifting customer needs.

CX Technology

Founded in 1972 in Taiwan, CX Technology originally produced bullets and bicycle parts. In response to changes in consumer demand in the late 1970s, the company shifted to producing speaker component parts exclusively. By 2009, with more than 30 years of experience in this market, CX Technology had become a dominant supplier with over 86 customers worldwide, including some of the largest names in audio equipment: Philips, Harman International, Pioneer, Panasonic, and Onkyo. Roughly 60% of CX Technology’s production served the automobile industry with the remaining 40% targeted at retail sales, i.e., home theater systems and stereo speakers. With a customer base that included the leading audio equipment makers, CX Technology’s components could be found in the full spectrum of automobile brands, from Kia to Ferrari.

As a critical link in the supply chain of many of its customers, CX Technology’s ability to deliver products up to specification on time earned the firm significant recognition over the years. Among its customers, CX Technology was reputed for its reliability and high quality products. In fact, the majority of its sales revenues came from repeat business. Additionally, CX Technology was able to leverage its impressive roster of customers to gain additional customers in an industry where a proven track record of success was vital.

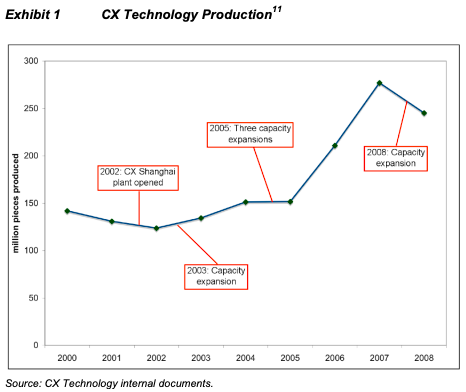

CX Technology’s strong performance in this market facilitated further growth. The company opened production plants in Ho Chi Minh City, Vietnam (CX-Vietnam) and Shanghai, China (CX-Shanghai) in 1996 and 2002, respectively, to accommodate new business. Because of its high volume and end applications in automotive and consumer electronics, the company had invested in acquiring ISO 14001 and ISO/TS 16949 certification and a fully implemented ERP system. Between 2002 and 2008, CX Technology had consistently invested in new capacity in both plants, growing production from nearly 142 million pieces in 2000 to more than 245 million in 2008 (Exhibit 1). By the start of 2009, CX Technology had over 1,300 employees and 140,000 square meters of manufacturing floor space.

Following the construction of its Vietnam and China plants, CX Technology’s Taiwan location was converted into the company headquarters, primarily housing administrative and financial activities. Meanwhile, CX Technology’s sales, marketing and R&D functions were dispersed throughout the three locations. The departments operated autonomously from their counterparts in the other locations, communicating once a week during status meetings. In 2008, however, Chairman Albert Ting made a push to consolidate sales, marketing and R&D under one department headed by Vice President Lee in CX-Taiwan. This decision was meant to capitalize on economies of scale and enable more efficient knowledge transfer throughout the company’s three production facilities.

CX Technology also surpassed its customers in quality assurance (QA). Improvements in QA processes led to defect rate reductions from 1.17% in 2007 to 0.31% in 2008 to an expected 0.04% defect rate in 2009. The lower defect rates translated to fewer customer issues: 179 in 2006 to 53 in 2008.

Capabilities

In addition to its long-term relationships with its customers, CX Technology felt its competitive advantage was its ability to do all manufacturing in-house and its quality processes, which, in combination, allowed it to charge a small price premium. CX Technology’s manufacturing capabilities included all steps of the cold forging process, from drawing to plating. The firm also designed and manufactured the tooling equipment used in the forging machines. In contrast, some manufacturers did not provide some of the later stages of manufacturing like CNC machining and plating, and often contracted out the tooling to third parties.

CX Technology also surpassed its customers in quality assurance (QA). Improvements in QA processes led to defect rate reductions from 1.17% in 2007 to 0.31% in 2008 to an expected 0.04% defect rate in 2009. The lower defect rates translated to fewer customer issues: 179 in 2006 to 53 in 2008.

Sales and Marketing

Since the majority of CX Technology’s revenue came from long-term relationships and repeat business, the company’s sales and marketing department did not have a lot of field experience. Marketing collateral was minimal, consisting of a sales presentation that highlighted the company’s experience and success as a speaker component manufacturer, and a detailed profile of the company and its history. The company’s website essentially reiterated this information.

In an effort to generate new business, the sales team pursued every lead and had the engineering team evaluate potential products for production. Due to the at times sensitive nature of the customer’s product design, it was typical for CX Technology to meet with potential customers several times before they would agree to send CX any product specifications. The total sales process, from first customer visit to prototype evaluation, could last between 1 and 4 years. The lack of information exchange upfront led CX Technology to expend a considerable amount of sales and R&D resources pursuing opportunities, often to discover that the component couldn’t be produced with CX Technology’s existing equipment, or even by cold forging at all.

This approach to sales was further complicated by the fact that many potential customers were not aware that certain parts of their product could be cold forged. Nor did they care. A buyer’s primary concern was finding a part that met physical specifications at a competitive price. Because it had to be more aggressive in pursuing this customer segment, CX Technology bore the upfront costs of investigating the technical and market opportunity aspects of products believed to contain cold forged parts. The company relied on intuition to identify these potential products. Some of the markets CX Technology had looked at included air conditioner compressors, washing machines, and motorcycles. Few, if any, of these pursuits yielded genuine leads or new expansion.

Challenges

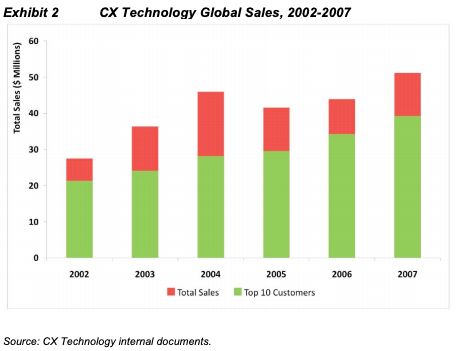

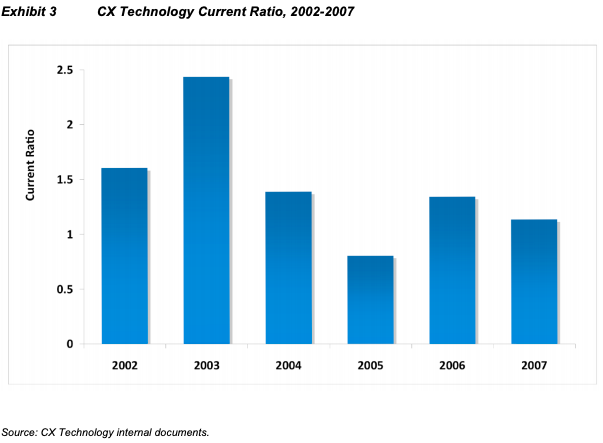

Yet expand it must. Although CX Technology enjoyed a leading position in the speaker system supply chain, Ting knew the company’s future was staked on diversification, and on penetrating at least one or two new markets. This imperative stemmed from two observations. First, CX Technology’s revenue was flattening. The company’s CAGR fell from 29% between 2002 and 2004 to 11% between 2005 and 2007 (Exhibit 2). Second, the company had the ability to handle new growth: as Vietnam’s largest cold-forged steel manufacturer, CX Technology had honed its operations over the years, and showed operational excellence with the fiscal discipline few of its competitors had (Exhibit 3). This put CX Technology at a strategic advantage. With centrally located operations in Southeast Asia, the company was in striking distance of other Southeast Asian economies as well as China, the fastest growing economy at the time. With overall production at only 60% of capacity, Ting knew CX Technology was poised to handle new business growth.

The big question was where. Cold forged steel components had many industrial applications, and in particular, as CX Technology’s Director of R&D Austin Chang put it, “the nature and quality of the type of parts CX Technology manufactures makes it a shoe-in for almost anything that has wheels.” For this reason alone, CX Technology’s leadership had long pondered broadening beyond automobile speaker components and directly entering the automotive industry, a sector that also prized the high quality and high volume CX Technology was especially suited to provide.

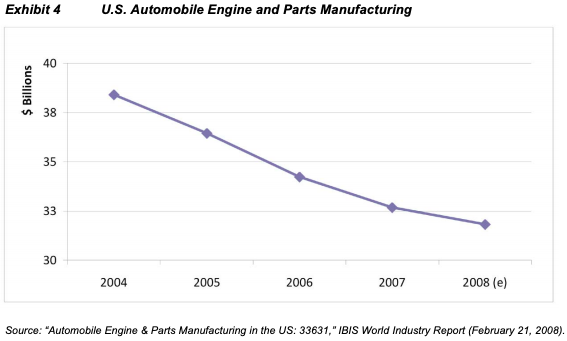

But to many observers in 2009, the future of the automotive industry looked bleak, if not catastrophic. In the United States, for decades the center of the automotive world, growth had reached a plateau, volumes had stagnated, and the major manufacturers faced bankruptcy. Among U.S. manufacturers of engines and parts – CX Technology’s potential customers and competitors – revenue had fallen by more than 17% over the past four years (Exhibit 4) and consolidation was rampant. Elsewhere car production was up but competition fierce, particularly among the suppliers popping up like mushrooms wherever labor was cheap. Any firm seeking to enter as a new Tier 2 supplier would be walking into a maelstrom, if not a minefield.

The Automotive Industry

Since the automotive industry’s inception, the production process had evolved from a single manufacturer to highly modularized production lines. The car was broken into subassemblies such as brakes, transmissions, engines and doors, which created smaller industries that focused on the production of these subassemblies.

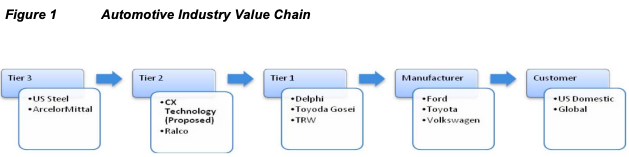

Manufacturers focused on the design, assembly, and marketing of complete cars. Their direct suppliers, referred to as Tier 1 suppliers, focused on the design and assembly of subassemblies. Tier 1 suppliers purchased smaller components that fit in their subassemblies, ranging from plastic moldings to nuts and bolts, from Tier 2 suppliers. Lastly, Tier 3 suppliers included all firms that provided raw materials and services to Tier 2s. (See Figure 1 for stages and sample players.)

By the early 21st century the industry was gripped by rapid and painful change. Slowing U.S. demand and the growth of emerging markets had sparked globalization as manufacturers scrambled to shift towards unmet demand. In turn, price pressures caused by competition emphasized the need for cost controls, and so localization was born to mitigate high logistics and transportation costs. Similarly, cost pressures from manufacturers suffering from low profitability caused consolidation across the supply chain. In many cases, manufacturers encouraged mergers to take advantage of cost reductions available from economies of scale. It was estimated that the number of global automotive manufacturers would decline from nine to six between 2002 and 2010. Similarly, Tier 1s would shrink dramatically from 600 to between 30 and 35, and Tier 2s from 10,000 to 800.5 It would be survival of the fittest, or the luckiest.

Growth Options

To survive might seem grueling, to enter foolhardy. True, CX Technology had built impressive expertise in supplying speaker components, the majority of which ended up in cars, but the firm had little experience dealing with the automotive industry directly. It was unclear which components could be cold forged and who the potential direct customers might be. And CX would not be able to count on the strong network and relationships that underlay nearly 30 years of success.

Despite these issues, Ting and his senior management team believed that the benefits of pursuing the automotive industry outweighed the costs, and they wanted a plan of attack. They considered three markets to be viable for entry: the United States, China, and Vietnam. Despite the industry’s current turmoil, each of these markets played to CX Technology’s strengths in its own way.

United States

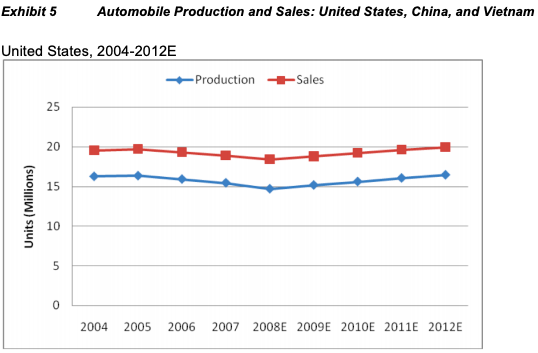

The recession of 2008-09 had created a precarious situation for both U.S. automotive manufacturers Ford, General Motors, and Chrysler (also known as the “Big Three”) and U.S.-based foreign manufacturers such as Toyota and Honda. Declining consumer demand and increasing sensitivity to rising gas prices had resulted in a significant decline of new vehicle purchases, though stabilization was expected by 2012. (See Exhibit 5 for production and sales projections for the United States, China, and Vietnam.) It wasn’t clear that the Big Three would survive that long, however, as they had approached the U.S. government in late 2008 for financial support totaling US$34 billion.6 Suppliers, too, were feeling the crunch with a similar reduction in engine and parts manufacturing revenues from US$38.3 billion in 2004 to US$31.8 billion in 2008. This resulted in dramatic consolidation, through bankruptcies and mergers, of both manufacturers and suppliers as profits disappeared and financial markets dried up.

Concerned about declining profitability, manufacturers paid increased attention to their suppliers’ per piece costs and the overall stability of their supply chain. Suppliers were required to guarantee annual reductions in costs and were subject to annual renegotiations of contracts. Adding to these conditions, manufacturers required would-be suppliers to maintain strong balance sheets and long-term financial stability. This implied that suppliers also had to become more rigorous in their own supplier selection process. (See Exhibit 6 for typical information required of prospective Tier 2 suppliers by their U.S. customers.) In some cases, manufacturers even involved themselves in their suppliers’ selection processes to further protect their supply chains. Suppliers could spend up to three years courting and proving themselves to potential clients before winning a new contract.

For CX Technology the major appeal of the United States was size. Although the very notion of a solvent U.S. automobile industry was in doubt in 2009, the American market for cars was still by far the largest in the world. Becoming an official Tier 2 supplier to the U.S. automotive supply chain, therefore, still came with the promise of sizable revenue streams. With softening sales through the prior decade, manufacturers had shifted towards a more consolidated and higher quality supply chain. CX Technology’s products fit the mold for high quality, with the added advantage of offering cost competitiveness because of comparatively lower labor costs relative to U.S. cold forgers.

China

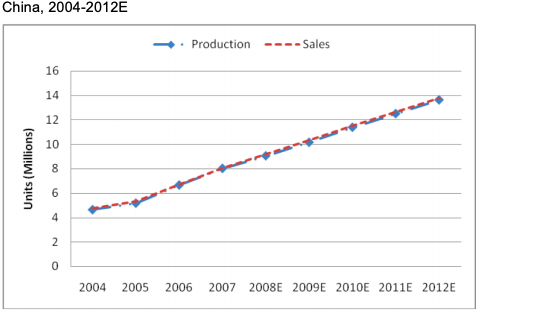

The Chinese automotive market was everything the United States market wasn’t: growing, and still relatively young. By 2008, China possessed the fastest growing consumer market in the world. With an automobile penetration of only 3%, compared to a world average of 12%, China presented a significant opportunity for automobile demand growth.7 Automotive manufacturers, both local and global, had opened operations in China with the majority of production allocated for domestic sales. Leading Tier 1 suppliers such as American Axle & Manufacturing, BorgWarner, Delphi, Visteon, and TRW had followed suit and set up manufacturing facilities in China as well. As the industry matured, manufacturers and suppliers began to look towards exporting to the global market.

Automobile production in China was forecasted to grow from 4.6 million units in 2004 to 13.6 million in 2012, a 14.4% CAGR. Leading domestic manufacturers, including ChinaFirst Automobile Group, Dongfeng Motor Corp, and Shanghai Automotive Industry Group Corp, commanded the largest portion of the local markets with 28.7% of sales volume. In 2006, China surpassed Germany to become the third largest automobile maker in the world behind the United States and Japan.

The rapid entry of automotive manufacturers in China had created unmet demand for reliable suppliers. Though many suppliers had already entered China, few had established a commanding presence in this fragmented automotive supplier industry. The situation was further emphasized deeper in the supply chain, with an uncountable and growing number of firms vying for contracts. However, if the United States was any indicator of what the industry would evolve into, it was only a matter of time before incumbent firms developed strong relationships.

In the eyes of CX senior management, a developing supply chain meant opportunities to forge longterm relationships with Tier 1s and supplant other Tier 2s. The firm could sell to educated customers who knew from bitter experience the value of stable, experienced, high-quality suppliers. Furthermore, CX Technology’s local presence and production facilities in China meant it could aggressively pursue business while avoiding expensive transportation costs.

Vietnam

Even closer to home was Vietnam itself. Although few local Vietnamese could afford cars, thanks to an annual per capita GDP (at purchasing power parity) of US$2,900, income was growing at a rate of 8.0%, foreshadowing demand growth in the region.9 Labor was still cheap, however – the average monthly income for a typical factory worker in Vietnam was around US$10010 – and the government was aggressively emphasizing low technology skills, export processing zones, and a business climate friendly to foreign direct investment. The abundance of low-cost trained workers had already attracted such manufacturing industries as oil, garment, tires, and bicycles. More recently a few big automotive brands such as Mercedes and Toyota had opened shop to cater to the rising appetites of the nearby emerging economies.

In early 2009 such manufacturers remained rare, however. Nearly all those that had entered focused only on final assembly, sales, and marketing, though plans were in place to ramp up assembly and perhaps manufacturing. Yet so nascent was the Vietnamese manufacturing industry that few suppliers had entered. Many in the supplier community wondered whether manufacturers would indeed increase automotive assembly in Vietnam. Even if they did, no one knew which parts the manufacturers would trust local suppliers to produce and which they would they continue to import from surrounding regions such as China and Thailand.

If anyone could succeed in this budding market, it would be CX Technology, or so Ting and his team believed. CX had the local presence, the established brand equity, and the demonstrable expertise in cold forging. It also wouldn’t have to jump headlong into the industry by making the most complex components, like engine parts. Because the Vietnamese market was in such an early stage of development, CX could begin with something simple – steering and suspension pieces, for example – and still be a leader in the Tier 2 field.

Conclusion

As Albert Ting returned to his office, he looked once more over the latest round of company financials. Although revenue had fallen in 2005, by 2008 things seemed to be back on track. Perhaps the company would be better served with a less drastic approach. Another option, after all, could be to look into industries that were perhaps less risky than automotive – bicycles, for instance, which CX Technology had served years before. More recently Hank Wu, CX Technology’s Deputy Director of Marketing, had sent Ting pictures he had found on the Internet, showing beer kegs that seemed to employ some type of cold-forged steel part around their spout mechanism. Hank had briefly annotated the pictures with the comment “Opportunity for CX?”, but had also cautioned that production feasibility would hinge on getting their hands on exact product specifications for those individual parts.

Whether Ting chose to pursue the automotive industry, or any other, this much was certain: a great deal of legwork would be needed to research each option, and he was uncertain whether his staff would have the necessary bandwidth. As he scanned his email, he saw out of the corner of his eye a reminder about his upcoming 10th reunion for his MBA class of the MIT Sloan School of Management. A few weeks back, at an alumni event, he recalled hearing a fellow alumna talk about the school’s Global Entrepreneurship Lab program (G-Lab), and sing its praises. The alumna said she had contracted with a team of four current MBA students to spend a semester examining new growth prospects for her company as part of their coursework. They then came on site and fleshed out recommendations, recommendations she was now eagerly implementing. Ting looked over at his desk and saw his classmate’s business card. It could be a possibility worth looking into. He swiveled his chair, picked up the phone, and dialed.

Question 1

Evaluate the internal resources and core capabilities of CX Technology. This should include as a minimum the value chain for this firm. Overall, what are the key strengths and weaknesses of CX Technology? (Johnson et al, 2014)

(30%)

Question 2

Conduct a detailed and systematic external environmental audit of the US automotive industry market. This should include as a minimum; PESTLE, 5-forces, industry life cycle and competitor analysis (Johnson et al, 2014). Overall, what do you conclude about the opportunities and threats for CX Technology?

(40%)

Question 3

Critically evaluate the factors that an organisation should investigate when considering entry into emerging markets. Use relevant theories and models to support your answer.

(30%)

References:

Bhole, K., Lee, J., Lu, E., Sen, I., 2009. CX Technology. MIT Sloan Management Case 09-092.

Johnson, G., Whittington, R., Scholes, K., Angwin, D., Regner, P. 2014. Exploring Strategy: text and cases. 10th edition. Harlow: FT Prentice Hall.

Ansoff, I.; 1957. Strategies for Diversification. Harvard Business Review, 35(5), 113-124.

MacLennan, A., 2011. Strategy Execution: Translating Strategy Into Action In Complex Organizations. London: Routledge.

Johnson G, Whittington R & Scholes K (2010) Exploring Strategy 9th Ed. FT Prentice Hall. ISBN-13: 978-0273737025

de Wit B & Meyer R (2010) Strategy: Process, Content, Context. 4th Ed. CENGAGE Learning. ISBN-13: 978-1408019023

Is this question part of your Assignment?

We can help

Our aim is to help you get A+ grades on your Coursework.

We handle assignments in a multiplicity of subject areas including Admission Essays, General Essays, Case Studies, Coursework, Dissertations, Editing, Research Papers, and Research proposals

Header Button Label: Get Started NowGet Started Header Button Label: View writing samplesView writing samples